Malaysia property might not be as hot as previous years, but the interest is still there. With the recent hike in interest rates and more hikes expected later this year, the instalment for properties will go up.

This then begs the question as to whether Malaysia property is still a good investment?

First of all, let’s look at some stats.

Malaysian House Price Index

House prices in Malaysia went up by almost 100% from 2010 to 2022 with the average price went up from RM220,154 to RM433,430.

But there has been a steady decline in recent years caused by the pandemic where demand went down and supply going up. The concept of supply and demand has influenced Malaysia property price to a certain extent.

The number of transactions were seen climbing up towards the end of last year before falling off a little bit.

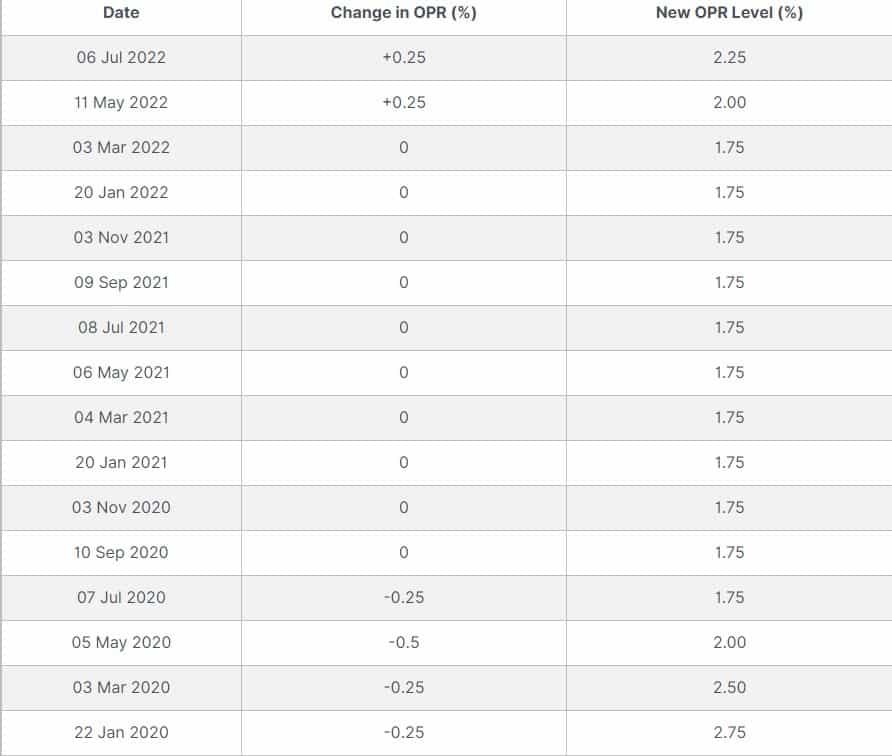

OPR (Overnight Policy Rate) Is On The Rise

Malaysia have been enjoying a very low interest rate since the pandemic begin. But with the recent OPR hike by Bank Negara Malaysia, this would have caused interest rate to rise, and subsequently the monthly instalment for houses to increase as well.

Analysts are predicting a few more rounds of OPR increase to curb the rising inflation by end of this year, which could cause house purchases to cool off.

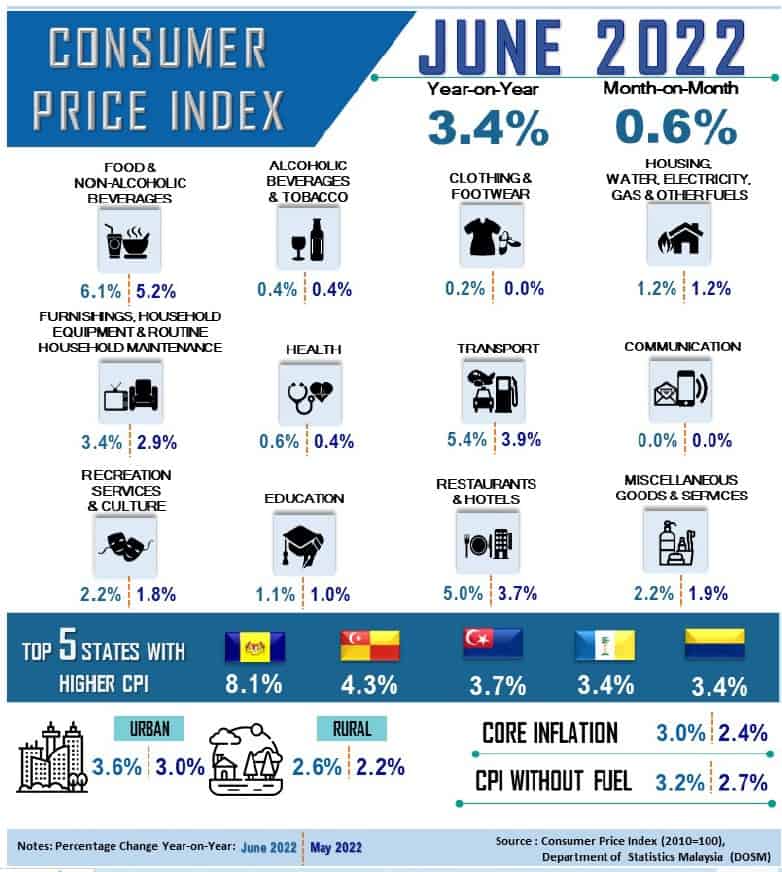

The Rise Of Inflation

Malaysia’s inflation increased 3.4%to 127.4 in June 2022 as against 123.2 in the same month of the preceding year. The Food index increased 6.1% and remained as the main contributor to the rise in the inflation during the month of June 2022.

When faced with high inflation, there will be lesser disposable income as everyone will be tightening their budget. Only those who have made the necessary preparation and is prioritizing in buying a house over other needs, will buy it.

The others will then have to rent, so more renters are expected to be on the market.

Ultimately only you can answer whether Malaysia property is worth investing in. Do you have the holding power? Are you able to find below market value and irresistible deals from the property market?

As the saying goes, it is about ‘buying low and selling high’. Do your homework and remember the mantra, ‘location, location, location’.

For more tips and tricks:

- 3 Key Lessons on Property Investment Tips for Beginners

- Property Investing In A Post-Pandemic World, 4 Things To Consider

- Investing In Property With A Holistic Perspective Using This 3-Step Process

- Property Investment: Make Money via Capital Gain & Rental Yield

Do you know how much is your Home Loan eligibility? Not sure how much you can borrow from the bank?

Get your TechRevo credit report + Home Loan Eligibility which includes:

- Credit history up to the past 12 months [CCRIS]

- Bankruptcy, Legal Suits, Legal action from banks, SAA, and Trade Bureau (Section E)

- Max home loan eligibility calculation up to 12 mortgage favorable banks in Malaysia

- CCRIS + Credit report + Calculator

It only takes 5 minutes. Click here now to get 50% off -> https://www.smartinvestor.com.my/techrevo