As companies budgets and business plans for 2026, the latest global Risk in Focus 2026 Report by the Institute of Internal Auditors Inc. warns that boards must urgently strengthen governance to keep pace with fast-evolving risks.

The report has outlined changes in top risks over the years in many regions, showing how cybersecurity, business resilience, disruptive technologies such as AI, and geopolitical volatility are converging into complex increasingly interconnected, challenging and intensifying.

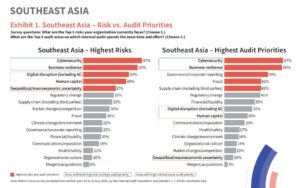

In the Risk in Focus 2026 Report’s regional deep-dives, Asia Pacific is highlighted as a fast-growing but risk-intensive region requiring urgent governance responses. Specially to Southeast Asia, the Report highlights that Cybersecurity (67%) tops the list as the number one threat, with AI, digital disruption, and data privacy expanding the attack surface. Business resilience (62%) comes second, reflecting the impact of tariff wars, supply chain shocks, and climate-related disruptions. The top two audit priorities for Southeast Asia (above 60%) mirror these threats.

For Southeast Asia, these trends not only heighten exposure but also present an opportunity: organisations that invest in the right resources, skills, and internal audit capabilities today will be better positioned to build resilience, sustain growth, and protect stakeholder trust in the years ahead.

However, while 52% of Southeast Asia survey respondents included digital disruption as a Top 5 risk – with AI reshaping competition and productivity, just 32% included it as a Top 5 audit priority. Many companies admit they lack the skills and frameworks to respond.

This year, the annual global report surveyed over 4,000 senior internal audit leaders worldwide, including 159 respondents from Southeast Asia who represent organisations with significant operations in the region. The 2026 edition introduces a forward-looking outlook — not just a snapshot of current risks but a projection of what boards cannot afford to ignore in the next three years. It also integrates AI, green finance, and geopolitical fragmentation as cross-cutting themes, which were less pronounced in earlier reports.

Malaysian Companies Under Pressure In 2026

Some of these risks are already manifesting and weighing on organisations in Malaysia. In 2024, police reports point to cybercrime losses exceeding RM1 billion, and yet, only 2% say they are prepared. That’s a governance gap with real financial consequences. Meanwhile ESG compliance pressures are also mounting with IFRS S1/S2 alignment this year and Scope 3 reporting by 2027.

Boards, therefore, cannot afford to de-prioritise these threats, and gaps between identified risks and internal audit coverage, particularly in areas such as cybersecurity, digital disruption and human capital which must be addressed with the appropriate control measures.

In these, internal auditors can support leadership in anticipating risks, testing resilience and building confidence with stakeholders. What were once operational — have now become business survival issues, and internal auditors are empowered to guide boards through this era of polycrises.

With organisations improving their resilience against “cascading failures”, The Institute of Internal Auditors Malaysia offers more than 90 training programs each year to elevate governance practices and foster a culture of transparency and accountability for businesses. IIAM recently launched the Statement of Risk Management and Internal Control (SORMIC) Guide 2025 with Bursa Malaysia which provides public-listed companies with a clear framework to strengthen disclosures, bolster investor confidence, and embed risk governance into their operations.

Demand for internal audit upskilling is also rising sharply: with growing enrolment in IIAM’s 80 programmes.” Continuous professional development and staying abreast of emerging trends are key to enabling internal auditors to excel in their roles. The Institute is central to equipping professionals with the knowledge, skills, and ethical standards necessary to comply with Global Internal Audit Standards effectively.